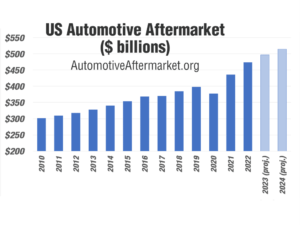

Total US automotive aftermarket industry size

- The US light-duty automotive aftermarket is a $405 billion industry (projected 2024) with a compound annual growth rate of 5.8% projected through 2026. Light-duty is a subset of the entire aftermarket.*

- The entire US aftermarket, including light, medium and heavy-duty vehicles, is projected at nearly $535 billion in 2024 and is projected to be around $574 billion in 2026.*

- It includes over 500,000 individual businesses consisting of independent manufacturers, repair shops, distributors, marketers and retailers. These businesses serve all 290+ million light, medium and heavy-duty vehicles registered in the US today.

How large is the automotive aftermarket industry?

The entire automotive aftermarket is projected at nearly $535 billion in after-sales parts and accessories in 2024. It services approximately 292 million light, medium and heavy-duty vehicles in operation (VIO) in the US.

The industry breaks down into different categories and markets; one common way to categorize it is by automotive/light truck and medium/heavy duty vehicles.*

The Auto Care Association represents the entire $370+ billion industry, also referred to as the “auto care industry.”

Total light-duty aftermarket size, a subset of the entire aftermarket industry

According to the Automotive Aftermarket Suppliers Association (AASA) the U.S. light-duty aftermarket parts market will be over $400 billion (projected 2024) with a compound annual growth rate of nearly 6% projected through 2026. The $400 billion number is up 4% from $389 billion in 2023.

The AASA industry size includes the automotive segment only (light-duty) and does not count the medium- and heavy-duty vehicles segment. Both the Auto Care Association and AASA agree on the $400+ billion industry size, as published in the Joint Channel Forecast Model, which is published by both trade associations.

Note that the word “automotive” is used generically and includes trucks and SUVs. Light-duty refers to vehicles that are gross vehicle weight rating (GVWR) classes up to Class 3. That is a maximum of 14,000 pounds.

Total size of the replacement tire market

According to Modern Tire Dealer (MTD) the replacement tire market for cars and trucks was a $39.6 billion market in 2017. This is a segment of the entire U.S. aftermarket. The replacement tire market breaks down into passenger cars at around $25 billion, medium and heavy duty trucks at around $7 billion, light trucks at about $5 billion, off-road vehicles including commercial vehicles at around $2 billion and farm vehicles at $0.5 billion. MTD broke those numbers down by shipped units and there were 208 million replacement passenger tires, 31 million replacement light truck tires and 19 replacement million medium and heavy duty truck tires shipped in 2017.***

According to Tire Business magazine, in 2019 aftermarket (replacement) passenger car and light truck tire shipments were up 2.2% and 2.5%****. The magazine puts the North American tire market at $48 billion in 2019.

The U.S. Tire Manufacturers Association (USTMA) forecasted a 3.4% drop in passenger car replacement tires and a 2.4% drop in light truck replacement tires for 2022 vs. 2021.

Total size of the specialty equipment automotive market

According to the Specialty Equipment Market Association (SEMA), the specialty equipment market, which is a subset of the entire automotive aftermarket, is projected at $53 billion in 2023. The specialty equipment market is sometimes referred to as the as performance parts and accessories market.*

Total size of the US online automotive parts market

Online sales of auto parts and accessories in the US, excluding markeplaces and used parts, was projected to be at $22.3 billion in 2024 according to a report issued by Auto Care Association and AASA. Several aftermarket companies including Hedges & Company, contributed to that report. The report puts third-party sales by marketplaces like Amazon, eBay and other third-party platforms at $21.8 billion in 2024. The total for aftermarket ecommerce is projected at $44.1 billion in 2024.

Digital influence on auto parts and accessories sales is projected at $77 billion in 2023 in the US. That includes sales through all sales channels (traditional retail and online) that are influenced by the Internet in 2023 including online research by consumers, Google search, manufacturer websites, videos and reseller reviews.

Total size of the automotive aftermarket in Canada

According to Automotive Industries Association of Canada (AIA Canada) the Canadian automotive aftermarket was at C$32.2 billion/US$23.7 billion of GDP in 2019. Employment has been growing at around 2.2% per year in recent years.** The Canadian aftermarket sector employed around 388,100 Canadians in 2015, up 2.2% from 379,800 the previous year. Ontario is the largest aftermarket province with 128,200 employees. Quebec and Alberta have the second and third largest total aftermarket employment with 87,400 and 55,100 employees, respectively. There are about 4,600 auto parts and accessories and tire store retailers in Canada in 2020. There are approximately 23,000 auto repair/service repair businesses in Canada. There were 25.6 million light vehicles registered in Canada in 2015, which was a 4.4% increase from the 24.5 million in 2014.

Total size of the automotive aftermarket in Mexico

The Mexican aftermarket is estimated to be just over US$4 billion in 2016 and is expected to grow at 5%-6% over the next several years and has approximately 30 million vehicles in operation (VIO) making it the world’s 11th largest fleet.* The Mexican automobile industry is expected to manufacture 5 million light vehicles for 13 makes, in over 30 automobile factories, by 2020.

Total size of the automotive aftermarket in China

The Chinese parts and repair aftermarket is projected at US$188 billion by 2020. It has the second largest VIO fleet in the world, behind the US, with around 139 million vehicles.*

*Sources: Auto Care Association, Hedges & Company, industry sources, Wikipedia, AASA

**Sources: AIA Canada

***Source: Modern Tire Dealer (MTD)

****Source: Tire Business

This was an interesting article about the automotive aftermarket. My dad is looking to get parts for his truck. I’ll share this article with him as he looks for auto parts.

Thanks for sharing information in your blog

The global automotive aftermarket is anticipated to witness a CAGR of 4.40% during the forecast period of 2017 to 2023. This projects consistent growth for the market. Valued at USD 824.82 Bn in 2017 and is expected to grow to reach an approximate value of USD 1,023.4 Bn by the end of 2023.